Home / Life Insurance / Articles / Life Insurance General / Who is an Appointee in Life Insurance?

Who is an Appointee in Life Insurance?

Neviya LaishramDec 22, 2025

Share Post

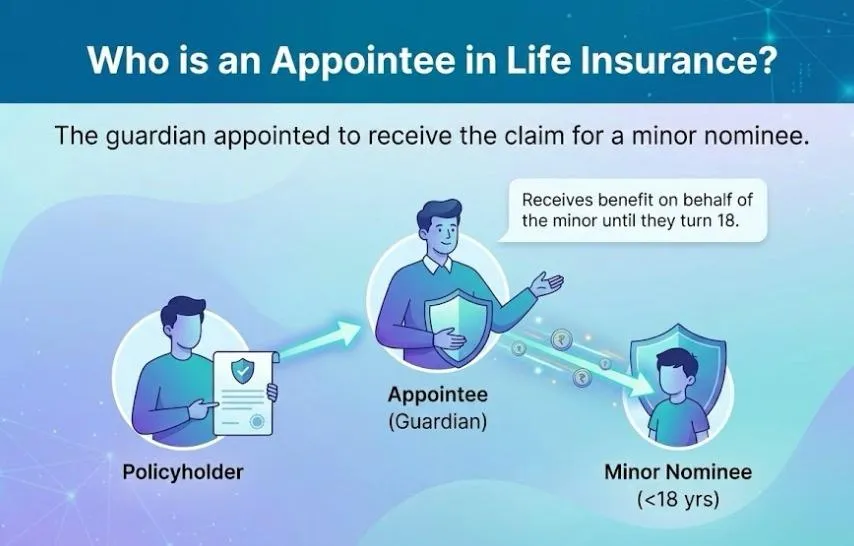

An appointee in life insurance is an adult authorised by the policyholder to receive and manage claim proceeds on behalf of a minor nominee until they turn 18.

Contents

Key Takeaways

An appointee is the person chosen by the policyholder to receive the policy proceeds if the nominee is under 18.

Appointee cannot claim ownership of the funds.

Their responsibility ends once the nominee becomes an adult.

When is an Appointee Required in Life Insurance?

An appointee is required in life insurance only when the nominee is a minor (below 18 years of age). Since minors are not legally allowed to receive insurance claim money directly, the insurer releases the claim amount to the appointee.

The appointee holds and manages the funds responsibly until the nominee becomes an adult, after which the appointee’s role automatically ends.

Who Can Be an Appointee in Life Insurance?

The appointee should ideally be someone you trust completely to act in the best interests of your nominee. Most insurers allow the following:

Parents

Spouse

Siblings

Legal guardians

Other trusted relatives (with insurer’s approval)

The non-negotiable requirement is that the appointee must be an adult (18 years or older), of sound mind, and acceptable to the insurer.

Appointee vs Nominee in Life Insurance in India

The terms nominee and appointee are often confused, but they serve very different purposes in a life insurance policy.

| Feature | Nominee | Appointee |

|---|---|---|

| Role | Beneficiary of the policy proceeds | Caretaker of proceeds for a minor nominee |

| Ownership | Nominee is the rightful recipient of the policy proceeds | Has no ownership, only acts as a trustee |

| Age | Can be a minor or an adult | Must be an adult |

| When Needed | Always named in policy | Required only if the nominee is a minor |

Real-Life Example Scenario

Policyholder: Anita, age 35

Nominee: Her daughter, age 12

Appointee: Anita’s husband (daughter’s father)

Sum Assured: ₹40,00,000

If Anita passes away before her daughter turns 18, the insurance company will release the claim amount of ₹40,00,000 to her husband, who is the appointee. But once the daughter turns 18, the custodial role of the father as the appointee ends automatically. Simply put, at 18, the daughter gains full legal rights over the funds.

How to Appoint an Appointee in Life Insurance

Appointing an appointee is a simple process and is usually done while buying the policy. You simply need to share the appointee’s details with the insurer.

1. During application: Insurers ask for the appointee's details at the proposal stage if the nominee is a minor.

2. Share the appointee’s details: This includes the appointee's name, age, relationship with the nominee, and contact details. Remember, this is an important step as the insurer must clearly identify who will manage the claim amount if needed.

3. Submit KYC documents: The insurer may also ask for identity and address proof of the appointee. This is to complete the verification process.

4. Policy confirmation: Once the insurer approves the details, the appointee’s name and information will be mentioned in the policy document for future reference.

If you ever need to change the appointee or update any of their details, you can do so by submitting a simple request to the insurance company.

Summary

An appointee in life insurance is needed when your nominee is under 18 years old. Since a minor cannot receive the insurance money directly, the appointee acts as a responsible adult who receives and looks after the claim amount until the child becomes an adult.

The appointee does not own the money. The nominee remains the rightful owner of the insurance amount. Choosing someone you trust as an appointee helps avoid confusion, delays, or family disputes and ensures your child’s financial future is protected. It is a simple step, but an important one, especially for policyholders who have chosen a minor nominee in their life insurance policy.

Frequently Asked Questions

Below are some of the frequently asked questions on Who is an Appointee in Life Insurance?

What is an appointee in life insurance?

An appointee in life insurance in India is an adult authorised by the policyholder to receive and manage the claim proceeds on behalf of a minor nominee until they turn 18.

When is an appointee required in life insurance?

An appointee is required only when the nominee is a minor (below 18 years of age), as minors cannot legally receive insurance claim money directly.

Can a minor be a nominee in life insurance?

Yes, a minor can be nominated in a life insurance policy. However, an appointee must be appointed to receive and safeguard the claim amount until the minor becomes an adult.

What is the difference between an appointee and a nominee in life insurance?

A nominee is the rightful beneficiary of the insurance proceeds. An appointee is a custodian who receives and manages the funds only when the nominee is a minor.

Can the appointee use the money for personal purposes?

No. The appointee does not own the money. They must hold and use the funds strictly in the best interest of the minor nominee.

What happens when the nominee turns 18?

Once the nominee turns 18, they gain full legal rights over the claim amount, and the appointee’s role ends automatically.

Can I change my appointee later?

Yes, you can change or update the appointee at any time by submitting a formal request to your insurance company.

What happens if I don’t appoint an appointee for a minor nominee?

If no appointee is mentioned and the nominee is a minor, the court may appoint a legal guardian, which can delay the claim settlement.

What happens if the appointee dies before the claim is paid?

If the appointee passes away before the claim arises, the insurer will ask for a new appointee to be appointed. If not updated, legal intervention may be required.

Can I have more than one appointee?

No. Usually, only one appointee is allowed per policy. If you want backup, you can update or change the appointee anytime.

What are the advantages of appointing an appointee?

Appointing an appointee is important for timely claim settlement for minor nominees. This avoids legal delays and gives the policyholder peace of mind that the funds will be handled responsibly.

Who can be an appointee?

An appointee must be an adult (18 years or older), of sound mind, and acceptable to the insurer. This is usually a parent, spouse, legal guardian, or another trusted family member.

Recent

Articles

Who is an Appointee in Life Insurance?

Neviya Laishram Dec 22, 2025

What is Survival Benefit in Life Insurance?

Neviya Laishram Dec 22, 2025

How to Renew Your Individual Health Insurance Policy Easily Online

Roocha Kanade Dec 19, 2025

Is ₹1 crore term insurance enough?

Neviya Laishram Dec 17, 2025

Can I Buy Travel Insurance Today for My Trip Starting Tomorrow?

Team Acko Dec 16, 2025

All Articles

Want to post any comments?

ACKO Term Life insurance reimagined

ARN:L0072|*T&Cs Apply

Check life insurance