Term insurance is the purest type of life insurance. It offers financial protection for a fixed period in return for a regular premium. The money your nominee receives as a payout (called the death benefit) can help cover important costs such as your children’s education, healthcare expenses, and daily needs like food and clothing.

1 Crore Term Insurance Starting @ ₹18/day*

18% Cheaper Now - Zero GST

Get instant savings with zero extra charges.

99.29% Claim settlement ratio*

Proven reliability your family can count on.

Save up to ₹54,600* on your taxes

Earn smart tax benefits while you protect.

Term insurance is the purest and most affordable form of life insurance. It is because a term insurance plan provides financial protection for a specific period in exchange for a fixed premium. It focuses purely on protecting the financial needs of your dependents in your absence. This means there is no investment or savings component, which is why term insurance premiums are cheaper.

In simple terms: You pay a fixed premium for a specified period (term), and if you pass away during this time, your family receives the sum assured (death benefit). If you survive the policy term, there's no payout.

Get a 1 crore term insurance plan starting @₹18/day*

ACKO’s term insurance comes with flexible, customisable features that support different life stages and financial goals. It gives you everything you need to protect your loved ones and plan for the future.

| Categories | Specifications |

| Sum Assured | ₹10 Lakhs to up to ₹90 Crores |

| Entry Age | From 18 years to 65 years |

| Tax Benefits | Save up to ₹54,600* on taxes |

| Claim Settlement Ratio | 99.29% |

| Affordable Premiums | Term Life Cover Starting @ just ₹18/day* |

| Claim process | Fully digital, simply upload the necessary documents on the app. |

| Death Benefit | Available |

| Critical Illness Cover | Available |

| Accidental Total Permanent Disability | Available |

| Accidental Death Benefit | Available |

| 100% Dedicated Claim Assistance | Available |

| Policy Term Flexibility | Available |

| Customisable Policy Coverage | Available |

According to the latest IRDAI annual report, life insurance penetration in India fell to 2.8%, down from 3% in 2022-23*. The decline reflects an increased protection gap, which means a large portion of the population is financially unprotected from life's uncertainties.

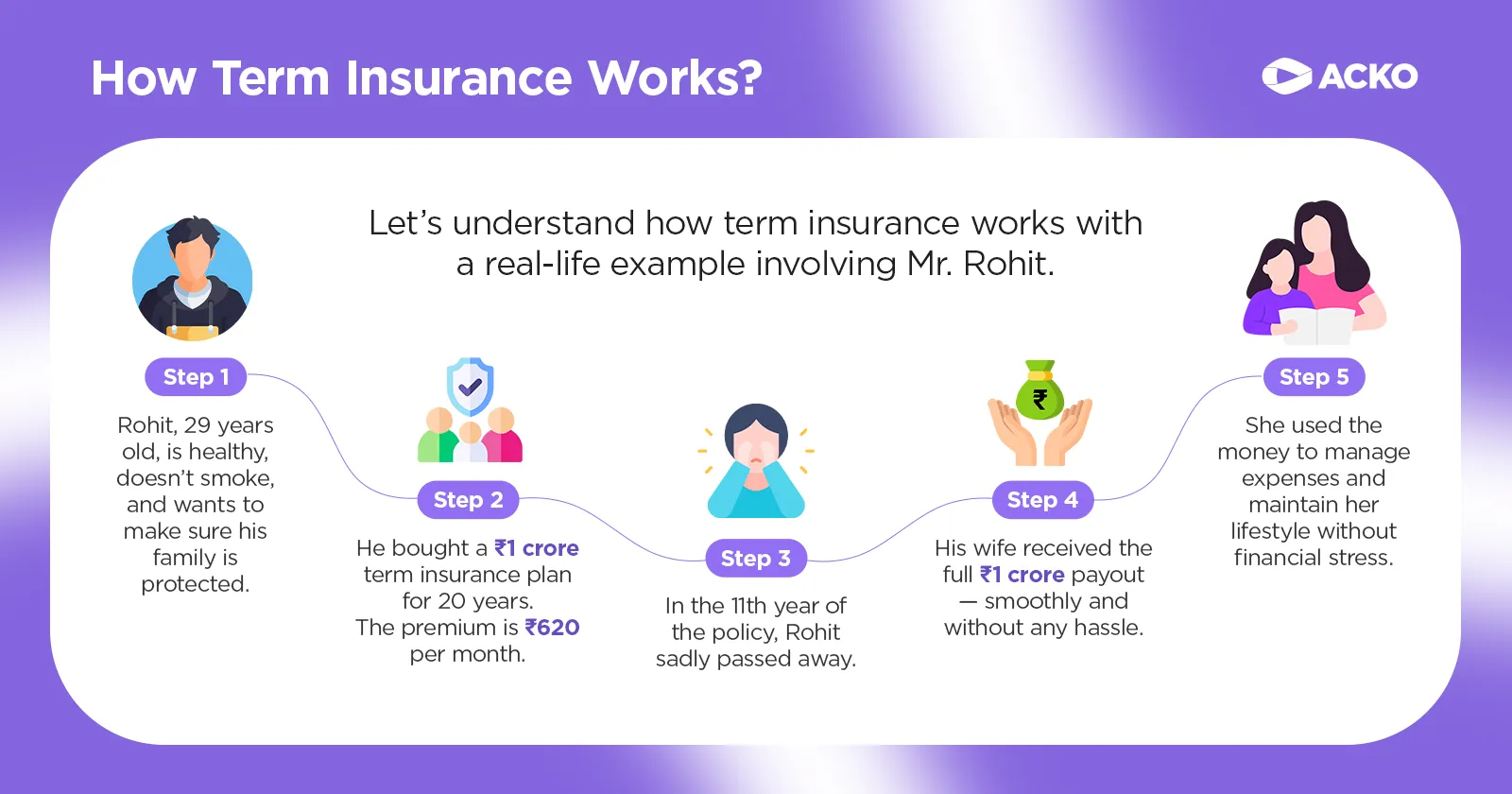

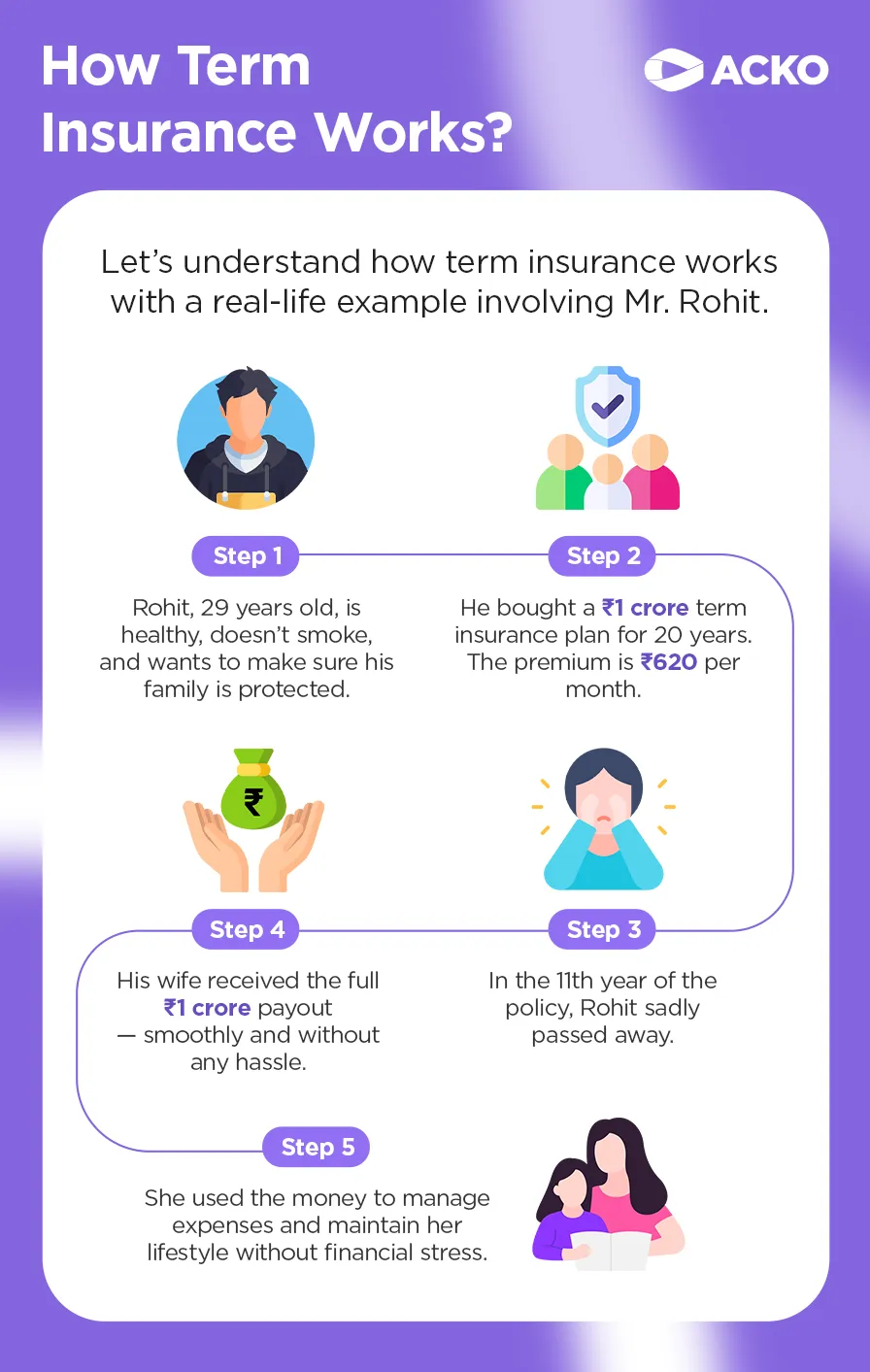

Let's see the way term coverage works in practical terms:

A 30-year-old non-smoker can get ₹1 crore term insurance cover for around ₹8,000-₹10,000 per year. Over 30 years, that’s just ₹2.4-₹3 lakh total premium in exchange for ₹1 crore life cover.

The right time to buy a term insurance plan is as early as possible, because the earlier you buy, the cheaper it is and the longer your family stays protected. When you wait even 5-10 years to buy term insurance, your premium can increase by thousands, and you will have a shorter number of years of protection.

Let’s understand this better with an example. The table below shows how premiums change based on your age at purchase and how buying early can save you thousands of rupees.

| Purchase Age | Annual Premium (₹1 Crore, till age 60) | Total Premiums Paid | Years of Coverage |

| 25 years | ₹7,200 | ₹2,52,000 (35 years) | 35 years |

| 30 years | ₹8,500 | ₹2,55,000 (30 years) | 30 years |

| 35 years | ₹11,800 | ₹2,95,000 (25 years) | 25 years |

| 40 years | ₹17,500 | ₹3,50,000 (20 years) | 20 years |

| 45 years | ₹28,000 | ₹4,20,000 (15 years) | 15 years |

Key Insight: Buying at 25 vs 35 saves around ₹43,000 in total premiums and gives you 10 extra years of coverage. Buying at 25 vs 45 saves approximately ₹1.68 lakhs and provides 20 additional years of protection.

Here’s how term insurance works in simple steps to ensure peace of mind for your family.

There are many reasons to buy term insurance in 2025. When you look at term insurance benefits, from how it protects your family to supporting children’s education and covering loan repayments, you see why it is so important.

Here’s why you should consider getting a term plan in 2025:

Term insurance is affordable, easy to understand, and offers a low entry age and debt protection. It also provides flexible premium payments, customisable coverage, and payout options. Here’s a quick look at the key features and benefits of term insurance plans.

Buying a term insurance plan is a practical option for everyone, especially those who are financially dependent, to secure their family’s finances in case something unfortunate happens. Here’s a list.

Choosing the best term life insurance at the right moment can make all the difference. Discover 6 important life scenarios where purchasing term insurance is a wise financial decision.

There are various types of term insurance available. But are they all similar? Definitely not. Let's understand the major types of term insurance plans in India.

| Plan Type | Maturity Benefit | Best For | Coverage Pattern |

| Pure Term (Level) | None | Everyone | Fixed throughout |

| Term with Return of Premium | 100% premiums back | Risk-averse individuals | Fixed throughout |

| Increasing Cover | None | Young professionals | Increases periodically |

| Decreasing Cover | None | Loan protection | Decreases over time |

| Convertible Term | None | Uncertain needs | Fixed, can convert later |

Now, let's walk through different types of term insurance plans available within India to understand how they work and which one may be the best fit for you.

This is the most basic and popular type of term plan where the sum assured remains fixed throughout the policy term.

Features:

Best for: Anyone looking for inexpensive life coverage without additional features.

This plan provides life cover and also returns all your premiums if you survive the policy term.

Features:

Best for: People who want life protection along with the assurance of getting their money back at the end of the term.

With this plan, your coverage automatically increases every year to keep pace with inflation or growing responsibilities.

Features:

Best for: Young professionals who expect their income, lifestyle, and financial needs to increase over time.

The coverage amount decreases gradually during the policy term, matching your loan balance.

Features:

Best for: Borrowers who want protection for large loans that reduce over time.

It allows you to convert your term plan into a whole life or endowment policy later, without the requirement of any medical tests.

Features:

Best for: Individuals who are unsure of their needs in the future and would like flexibility to switch plans later.

It is a term life insurance policy provided by the employer to employees as an additional benefit.

Features:

Best for: Employees desiring basic life insurance through their workplace.

ACKO Life Flexi Term Plan is a modern, flexible, and customer-centric solution for long-term financial protection. It not only offers inflation protection through premium lock-ins but also provides a unique level of policy flexibility unmatched by most traditional insurers. The convenience of managing the entire policy lifecycle digitally adds to its appeal, particularly for individuals who prioritise ease of use and adaptability.

ACKO offers a fully digital policy management system. Policyholders can easily make any policy adjustments (endorsements) such as:

Many traditional insurers require offline, time-consuming processes for policy adjustments, often involving paperwork or visits to branch offices. ACKO’s completely digital process offers unmatched convenience, especially for tech-savvy consumers.

The ACKO Life Flexi Term Plan starts at just ₹18/day*, and adapts as your life changes. Watch this video to learn everything you need to know about ACKO’s Term Insurance Plan.

Looking for the best term insurance in India 2025? Buy one of India’s best term insurance plans starting at just ₹18/day. With ACKO Term insurance, you get complete flexibility to customise your coverage amount and policy term to match your changing life goals.

The table below compares the ACKO Term insurance Plan with traditional term insurance plans, highlighting key differences in flexibility, premium payment options, and value-added features, so you can decide which is the best term insurance plan in India 2025 for your needs.

| Parameters | ACKO Life Flexi Term Plan | Traditional Plans |

| Claim Settlement Ratio | 99.29% | Varies from 98-99% |

| Policy Adjustments | Instant changes via app | Depends on the medium ( offline and online ) |

| Increasing Cover Option | Yes. No restrictions* | Restricted to life's big events such as marriage, welcoming a child, etc. |

| Cost Savings | Up to 40% savings* | Costs grow over time |

| Future Premium Hikes | Age-wise premiums remain the same | Age-wise inflation-adjusted premium |

| Customisability | Flexible coverage/term | Rigid, limited options |

| Riders | Offers valuable riders to enhance protection | Riders may be provided, depending on the plans |

| Length of Claim Form | Easy, digital, and short | Moderately long/Very long/Not available online |

| Option to Exit the Plan | Yes* | Approx. 80% of insurers provide |

| Digital Experience | Fully online, app-based 📱 | Often requires offline processes, paperwork, or branch visits |

| End-to-end Digital Support | Yes | Depends on the insurer |

| Free Will Creation | Yes | No, Generally does not offer integrated will creation services |

When you first buy ACKO’s Flexi Plan, the premium rates for different coverage amounts are fixed based on your age at the time you start the policy.

In the last 4 years, term insurance premiums have increased by more than 40% on average. ACKO's Life Flexi Term Plan can potentially help you save up to 40% on premiums in the long run, assuming these historical price trends continue. Most market plans do not offer a similar lock-in mechanism for future premium hikes related to sum assured increases.

Choosing the best term insurance plan in India can feel confusing. You want something that fits your needs just right. Here are the steps to help you pick the right term insurance plan for you.

Choosing the right term insurance depends on factors like your age, policy duration, and salary. Here are some popular ways to choose the best term insurance plan in 2025.

Age plays a key role in deciding your term insurance premium. As you grow older, the premium amount usually increases, and your life cover needs may also change. That’s why it is important to choose the right coverage amount based on your age and financial requirements.

The right term (duration) for an insurance policy is based on your needs and situation. Consider a few of the following when pre-determining how long your term should last.

Here are some of the popular policy terms in term insurance that many people prefer.

Your budget is crucial in choosing the right sum assured. Ensure the premium you'll pay for the term plan comfortably fits your budget. You want to avoid straining your finances by going for a sum that's too high. Here are some popular options in term insurance for salaried individuals:

Read more about other term insurance options based on your life stages and financial goals.

Let’s examine how term insurance can protect a family’s future using Mr. Suresh as an example, a regular, responsible family man.

Mr. Suresh was a 32-year-old software engineer living in Bengaluru. He was the sole earning member of a family of four: his wife and two young children. He had many dreams to fulfil. But life took a tragic turn when he passed away suddenly. What made all the difference was that Mr. Suresh had a ₹1 crore term insurance plan.

Now, let’s look at how that one decision protected his family’s future:

Several key factors affect premiums for term insurance plans. Some of them include your age, health, lifestyle habits, coverage amount, and policy duration.

Your age plays a big role. The younger you are when you buy a term insurance policy, the lower your premium will be.

Studies indicate that women, on average, live longer than men. Thus, women typically pay lower premiums due to higher life expectancy.

| Age | Coverage | Male (Non-smoker) | Female (Non-smoker) | Savings for Women | % Difference |

| 25 | ₹1 crore (30-yr) | ₹7,200 | ₹6,100 | ₹1,100/year = ₹33,000 lifetime | 15% |

| 30 | ₹1 crore (30-yr) | ₹8,500 | ₹7,200 | ₹1,300/year = ₹39,000 lifetime | 15% |

| 35 | ₹1 crore (25-yr) | ₹11,800 | ₹10,200 | ₹1,600/year = ₹40,000 lifetime | 14% |

| 40 | ₹1 crore (20-yr) | ₹17,500 | ₹15,200 | ₹2,300/year = ₹46,000 lifetime | 13% |

Disclaimer: Premiums are approximate averages for healthy, non-smoking individuals. Actual premiums vary by insurer, policy term, health status, and any selected riders.

Because of your increased mortality risk, smoking and tobacco use greatly raise your premium.

| Age | Coverage | Non-Smoker Premium | Smoker Premium | Extra Cost for Smoking | Lifetime Extra Cost |

| 25 | ₹1 crore (30-yr) | ₹7,200 | ₹10,500 | ₹3,300/year | ₹99,000 |

| 30 | ₹1 crore (30-yr) | ₹8,500 | ₹12,500 | ₹4,000/year | ₹1,20,000 |

| 35 | ₹1 crore (25-yr) | ₹11,800 | ₹17,200 | ₹5,400/year | ₹1,35,000 |

| 40 | ₹1 crore (20-yr) | ₹17,500 | ₹26,000 | ₹8,500/year | ₹1,70,000 |

To insurers, “smoker” means not just someone who smokes cigarettes. It includes someone who consumes any form of nicotine.

This includes:

Your current health and your medical history have a big impact on your premiums. Here are some of the conditions that will affect your premiums:

Minor impact (0-15% loading):

Moderate impact (15-50% loading):

Significant impact (50%+ loading or decline):

The actual premium loading depends on your health reports, insurer’s underwriting policy, and the stability of your medical condition.

Your profession and lifestyle activities affect your risk profile and premium rates.

| Risk Category | Occupations | Premium Loading | Special Conditions |

| Standard Risk | Office workers, teachers, IT professionals, doctors, and accountants | No loading | Standard terms |

| Low Hazard | Engineers (non-field), managers, consultants, bankers | 0-5% loading | Standard terms |

| Medium Hazard | Field engineers, journalists, sales executives (extensive travel) | 10-15% loading | May require additional questionnaire |

| High Hazard | Pilots, defence personnel, mining workers | 20-40% loading | Special exclusions may apply |

The length of your insurance policy will also affect the premium. A longer policy term will attract higher premiums than a shorter policy term.

Let’s say a 30-year-old buys ₹1 crore cover:

Disclaimer: These premiums are estimated prices only and will vary based on age, health, as well as the insurer’s underwriting policy.

Choosing the right term insurance cover is important. It helps protect your family’s future if something happens to you. Here’s a simple way to figure it out:

The sum assured is the prime factor in a term insurance policy, as it forms the actual amount the insurance company pays out to the beneficiaries in case of the death of the policyholder. Here's why it is an important factors:

Here are some of the most common coverage options to explore:

You want to make sure your family is financially secure if something happens to you. But you need to figure out how much coverage you need or how much it will cost. That's where a Term Insurance Calculator comes in. In simple terms, a Term Insurance Calculator helps you determine how much insurance you need and how much it will cost. It's like a virtual assistant that takes the guesswork out of protecting your loved ones financially.

Then, the calculator does some quick maths and gives you an estimate of how much you'll pay for the insurance each month or year. It also tells you how long the coverage will last (usually a specific number of years).

The right term for an insurance policy is based on your needs and situation. Consider a few of the following when pre-determining how long your term should last.

There are different payout options in term insurance to match your family's needs. Term insurance payout options can include a lump sum, monthly income, or a combination of both.

Remember to choose the right death benefit payout option in your term insurance plan. To do that, first check what options your insurance company is offering. Then, think about what suits your family best. For example, do you have any loans to pay off? Who is your nominee, and can they manage money well? Accordingly, select your term insurance payout option wisely.

A term insurance rider is an optional add-on to a term life insurance policy that offers additional benefits and enhanced coverage. There are various types of term life insurance riders available in India, such as critical illness rider, accidental death benefit rider, critical illness and more.

You can choose riders based on what you need and what you can afford. Riders cost a little extra, so pick only the ones that give you useful benefits without making the premium too expensive.

Let's take a closer look at some of the important term riders offered by ACKO. You can easily add these unique term insurance riders to your ACKO Life Flexi Term Plan.

ACKO Life Critical Illness Benefit Rider is an extra layer of protection for your term insurance. If you get seriously ill, this rider can provide you with a large amount of money to help you through a tough time.

Another key benefit of this rider is that ACKO waives off all future premium payments due for your ACKO Life Flexi Term Plan. We cover 21 critical illnesses, including life-threatening common illnesses among women, such as breast cancer, cervical cancer, fallopian cancer and ovarian cancer.

List of Covered Critical Illnesses:

| ✔️ Cancer of Specified Severity | ✔️ Myocardial Infarction (First Heart Attack Of Specific Severity) |

| ✔️ Open Chest CABG | ✔️ Open Heart Replacement Or Repair Of Heart Valves |

| ✔️ Coma Of Specified Severity | ✔️ Kidney Failure Requiring Regular Dialysis |

| ✔️ Stroke Resulting In Permanent Symptoms | ✔️Major Organ /Bone Marrow Transplant |

| ✔️ Permanent Paralysis Of Limbs | ✔️ Motor Neuron Disease With Permanent Symptoms |

| ✔️ Multiple Sclerosis With Persisting Symptoms | ✔️ Benign Brain Tumor |

| ✔️ Blindness | ✔️ Deafness |

| ✔️ End Stage Lung Failure | ✔️ End Stage Liver Failure |

| ✔️ Loss Of Speech | ✔️ Loss Of Limbs |

| ✔️ Major Head Trauma | ✔️ Primary (Idiopathic) Pulmonary Hypertension |

| ✔️Third Degree Burns | |

ACKO Life Accidental Death Benefit Rider is one of the most affordable riders, purely designed to protect your family with an additional amount of money if your death is caused by an accident.

Accidental Total Permanent Disability Rider is designed to protect your financial well-being in case a major accident leaves you permanently unable to work or care for yourself. It provides an extra amount to cover daily expenses. Additionally, we will waive off all future premiums of your ACKO Life Flexi Term Plan.

Term insurance riders are useful because they enhance your basic cover and give your family more financial security. Here are 4 key reasons why riders are important:

ACKO Life makes it easy to file a term insurance claim. There’s no paperwork; you can do it anytime on the app, and a support team is always ready to help.

To take a term insurance policy, you must fulfil certain eligibility criteria defined by the insurer. Knowing these criteria helps you select the appropriate plan.

Note: Satisfying these conditions gives you a seamless approval process and brings you closer to ensuring your dear ones' future.

Term insurance gives financial help to your family. However, it’s important to know what it does and doesn’t cover. Always read the policy document to understand the full list.

| What is Covered in Term Insurance: | What is Not Covered in Term Insurance: |

| Death Due to Illness | Death Due to Suicide in the First Year |

| Death Due to Accidents | Death from Risky Activities |

| Death Due to COVID-19 or Other Pandemic Diseases | Death from Criminal Acts |

| Death Due to Natural Causes | Death Due to pre-existing illnesses (undeclared) |

People make a lot of mistakes for various reasons when buying term insurance online. Here are some common mistakes you should avoid while buying term insurance in India:

Buying a term plan online is quick, simple, and convenient. You can easily compare plans, choose what suits you best, and skip the paperwork. When you buy from ACKO, you get a smooth digital experience, transparent pricing, and helpful support. Here are some of the key benefits of buying your term insurance plan online:

The process to buy the ACKO Life Flexi Term Plan is simple and straightforward. Follow the steps below:

Note: This is a generic process; the exact steps can vary depending on the chosen plan and other details.

To buy a term insurance plan in India, you need a few simple documents. These help the company verify your details.

ID Proof

Address Proof

Age Proof

Income Proof

Medical Reports (if asked)

Nominee KYC Documents

To make a life term plan claim, you need to keep some important documents ready. Here is a list of documents required for a life insurance claim as per IRDAI.

Term insurance should give you peace of mind, knowing your family is protected. And getting covered should be just as easy.

We’ve made the buying process simple, quick, and transparent — with zero confusion.

Rated 4.6/5 with over 13626 reviews on Google

See all reviews

Understanding these common terms will help you make better choices when buying a term insurance plan in India. Here is a list of some of the most important term plan terminologies.

Choose term insurance smarter with city-specific insights on coverage, costs, and the protection your family truly needs.

Here are some common questions about Term Plans in India.

ACKO Life Insurance is doubling down on its protection focus, prioritising term insurance while also planning to expand into pensions and annuities, said the company's CEO Sandip Goenka, during an interaction with Moneycontrol. Read more

ACKO Tech, the parent company of ACKO General Insurance, has announced its expansion into the life insurance sector with the launch of ACKO Life Insurance. The company's debut offering is ACKO Flexi Term Life Insurance Plan. Read more

ACKO Tech, the parent company of ACKO General Insurance, has launched ACKO Life Insurance with its new Flexi Term Life Insurance Plan. This move marks ACKO's expansion from general to life insurance. The ACKO Flexi Term Life Insurance Plan offers customizable coverage to adapt Read more

Disclaimer: The content on this page is generic and shared only for informational and explanatory purposes. It is based on industry experience and several secondary sources on the internet, and is subject to changes. Please go through the applicable policy wordings for updated ACKO-centric content, and before making any insurance-related decisions. For full disclaimer kindly click https://www.acko.com/life/disclaimer/