speak for ACKO

speak for ACKO

speak for ACKO

Home / Life Insurance / Articles / Life Insurance General / What is Survival Benefit in Life Insurance?

What is Survival Benefit in Life Insurance?

Neviya LaishramDec 22, 2025

Share Post

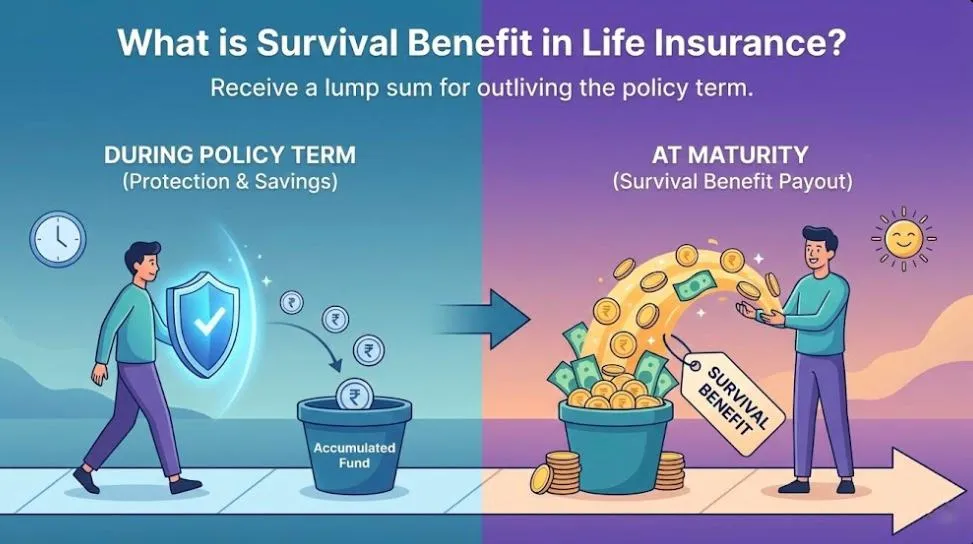

A survival benefit is an additional benefit that the insurer pays directly to the policyholder for surviving beyond a specific period of the policy term. Survival benefits are different from maturity benefits and death benefits.

A death benefit is paid on death.

A maturity benefit is paid when the policy term ends.

Survival benefits are paid in between, during the policy term, if the policyholder is alive.

Survival benefits meaning in life insurance, refer to receiving periodic payouts from a policy while the life cover continues. This feature is commonly offered in savings-linked life insurance plans, such as endowment plans and money-back policies.

Contents

Key Takeaways

With a survival benefit, you receive money from your life insurance policy at certain points during the policy term, instead of waiting only until the end.

Even after you receive survival benefit payouts, your life insurance cover continues as usual.

Survival benefit is not available in pure term insurance.

Real-Life Example

Imagine you take a life insurance policy for 20 years with a cover of ₹10 lakhs. Instead of waiting till the very end, the policy gives you money back at regular intervals:

After 5 years, you get ₹2 lakhs.

After 10 years, you get another ₹2 lakhs.

After 15 years, you get ₹2 lakhs again.

At the end of 20 years, you receive the remaining ₹4 lakhs along with any bonuses.

Now, if something happens to you during these 20 years, your family will still receive the full ₹10 lakhs as the death benefit, regardless of how much you’ve already received as survival benefits.

Survival Benefit vs. Maturity Benefit

It’s easy to confuse survival benefits with maturity benefits as they sound similar. Let's look at a quick comparison between the two.

| Feature | Survival benefit | Maturity benefit |

|---|---|---|

| Meaning | Periodic payments made to the policyholder at set intervals during the policy period | Lump sum amount paid to the policyholder at the end of the policy, given they survive the policy period. |

| Timing | Paid at specific milestones, for example, 5th, 10th, 15th year | Paid at once, at the end of the policy period |

| Purpose | Provides liquidity during the policy term for expenses like education, medical needs, or milestones. | Provides a large fund at the end for long-term goals like retirement or wealth creation. |

| Policy type | Common in money-back and some endowment plans. | Available in most traditional life insurance and endowment policies. |

| Impact | Life cover continues even after receiving survival benefits. | Life cover usually ends once the maturity benefit is paid. |

| Payment amount | A percentage of the sum assured at intervals. | Remaining sum assured + bonuses (if applicable). |

Advantages of Survival Benefit in Life Insurance

Survival benefits combine periodic payouts with ongoing life insurance protection. Below are some of the key advantages of survival benefits in life insurance.

Liquidity during the policy term: Instead of waiting until the end, you receive funds at regular intervals, which can be used for goals like children’s education, home renovation, or medical expenses.

Dual advantage of protection + returns: You stay insured while also receiving money during your lifetime.

Reduced financial stress: The payouts can act as supplementary income at critical stages of life.

Long-term savings: Getting regular payments keeps you connected to your policy and makes you less likely to give it up early.

Peace of mind: You know that even if something happens to you, your family still gets the death benefit from the policy.

3 Things You Should Know Before Choosing Survival Benefits

A survival benefit can be helpful, but it also comes with a few drawbacks you should be aware of:

Returns are smaller compared to market investments: The returns you get are usually less than what market-linked options like mutual funds or stocks might offer.

Fixed schedule: The money comes at fixed times. You don’t get to choose when you’ll receive it, even if your needs change later.

Higher cost: Policies that have survival benefits usually come with higher premiums than simple term insurance (no payouts if you survive).

Conclusion

Survival benefit is a feature available in various life insurance plans that provides pre-planned payouts during the policy term, as long as the policyholder is alive. While survival benefits may not deliver returns as high as market-linked investments like mutual funds, they offer something different: certainty and stability. The payouts are predictable and can help meet planned expenses or financial milestones, all while the insurance cover continues.

FAQs About Survival Benefit

Below are some of the frequently asked questions on What is Survival Benefit in Life Insurance?

What is a survival benefit?

Survival benefit is the payment you receive at specific intervals during the policy for surviving the policy period.

Will this make my maturity benefit amount less?

Yes, since you receive part of the sum assured, the final maturity payment is adjusted accordingly.

Do all life insurance plans offer survival benefits?

No. Survival benefits are not offered in all life insurance plans. Pure protection plans like term insurance don’t provide this feature as they only give you the death benefit.

Can I still get the death benefit if I already got the survival benefit?

Yes. Your nominee will still receive the full death benefit if something happens to you during the policy term.

Do term insurance plans have this benefit?

No. Survival benefits are mostly found in money-back policies.

Was this article helpful?

Recent

Articles

Pure Term Insurance vs Money Back Policy: Which Is Better in India?

Neviya Laishram Jan 14, 2026

Is ULIP Really Worth It?

Neviya Laishram Jan 14, 2026

Should I Rely Only on Employer Group Term Insurance or Buy a Pure Term Plan?

Neviya Laishram Jan 14, 2026

What Does ‘Pure Term Insurance’ Really Mean for Your Loved Ones?

Neviya Laishram Jan 14, 2026

Why Life Insurance Isn’t Meant to Be an Investment

Neviya Laishram Jan 14, 2026

All Articles

Want to post any comments?

ACKO Term Life insurance reimagined

ARN:L0072|*T&Cs Apply

Check life insurance