speak for ACKO

speak for ACKO

speak for ACKO

Home / Life Insurance / Articles / Life Insurance General / How Inflation Impacts Your Term Insurance Coverage

How Inflation Impacts Your Term Insurance Coverage

Neviya LaishramDec 15, 2025

Share Post

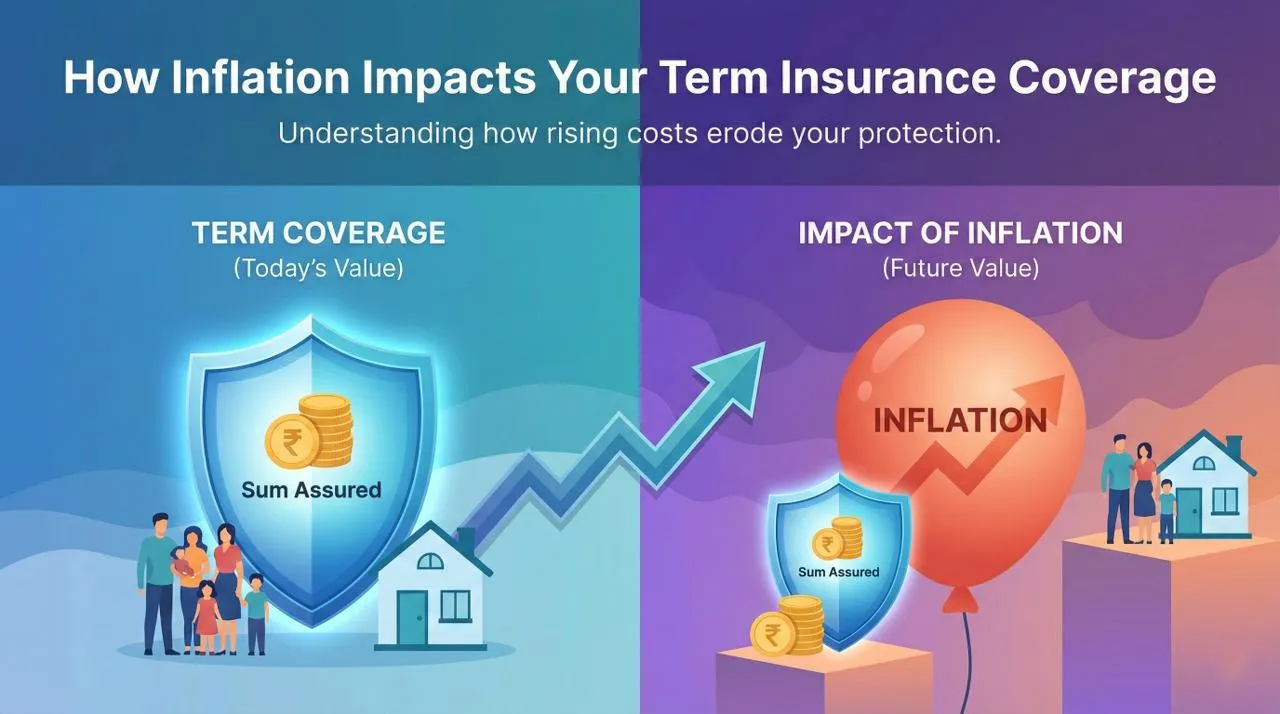

Have you ever noticed that the same basket of groceries you purchased for ₹1,000 is now costing more than ₹2,000? That's inflation. It affects more than just your shopping list; it also reduces the value of your term insurance coverage. When you purchase a term plan, your purpose is simple: to ensure your loved ones remain financially supported in the event of your death. However, fast-forward 15 or 20 years, and rising prices can quietly reduce that protection.

Let’s look at the effect of inflation on your term plan and, most importantly, what you can do to ensure your family’s future is secure.

Contents

How Inflation Reduces the Value of Term Insurance Coverage

Inflation simply means that the cost of living rises over time while the value of money decreases. In other words, what ₹100 can buy today might only buy goods worth about ₹50 a decade from now.

In the case of term insurance, inflation can reduce the value of your coverage. Most term insurance plans offer a fixed payout. That means the sum assured remains the same throughout the policy term. But while your payout stays the same, your family’s expenses won’t.

Let’s look at what happens:

Purchasing power drops: Your cover’s value doesn’t increase, but the cost of essentials does.

Lifestyle costs rise: Education, rent, and healthcare increase at a faster rate. As years pass, that fixed payout that once felt “more than enough” might start to feel smaller and smaller in real life.

Coverage gap widens: Over time, your original ₹1 crore cover might only meet half of your family’s financial needs.

How does inflation impact the value of ₹1 crore cover?

Let’s assume an average inflation rate of approximately 6% per year (just for illustration, as actual inflation can fluctuate over time).

Here’s how inflation can gradually reduce the real value of your ₹1 crore term cover.

Years Later | Approximate Value (in today’s money) |

|---|---|

Today | ₹1,00,00,000 |

After 10 years | ₹55,80,000 |

After 20 years | ₹31,00,000 |

After 30 years | ₹17,90,000 |

So, what does this mean in simple terms? If your family’s current lifestyle, education costs, home EMIs, and medical needs would require ₹1 crore today, those same expenses could easily touch ₹3 crore or more after 20 years.

That’s how inflation quietly erodes the value of a ₹1 crore cover. The number on paper might still say ₹1 crore, but what it can actually buy keeps shrinking over time.

How to Protect Your Term Plan from Inflation

You can’t stop inflation, but you can plan around it. Here’s how:

Opt for an Increasing Term Plan: Some insurers offer plans that automatically increase your cover amount every year to offset inflation.

Review and Upgrade Regularly: Reassess your life insurance coverage regularly. As your income and expenses grow, so should your insurance.

Add Riders Smartly: Riders like accidental or critical illness benefits can add an extra layer of safety against unexpected costs.

Conclusion

While inflation is invisible, its impact is very real. Although a ₹1 crore term plan may look like a good protection today, its value can decline considerably over the years. That’s why it’s so important to choose a plan that grows with you. Reviewing your cover every few years helps ensure it still provides your family with the protection you originally intended.

Frequently Asked Questions

Below are some of the frequently asked questions on How Inflation Impacts Your Term Insurance Coverage

How does inflation impact the value of a ₹1 crore cover?

Inflation reduces the purchasing power of money, which means a ₹1 crore policy today may be worth much less after 10 years.

What is an inflation-linked term insurance plan?

It’s a plan where your sum assured automatically increases each year (usually by 5–10%) to match inflation, ensuring your coverage doesn’t lose value over time.

Can I increase my term insurance cover after purchase?

Yes, with the ACKO Life Flexi Term Plan, you can increase your coverage at any time as your financial needs change.

Does term insurance automatically adjust for inflation?

No. Standard term plans have a fixed payout. To protect against inflation, choose a policy with increasing coverage.

Recent

Articles

Who is an Appointee in Life Insurance?

Neviya Laishram Dec 22, 2025

What is Survival Benefit in Life Insurance?

Neviya Laishram Dec 22, 2025

How to Renew Your Individual Health Insurance Policy Easily Online

Roocha Kanade Dec 19, 2025

Is ₹1 crore term insurance enough?

Neviya Laishram Dec 17, 2025

Does Travel Insurance Cover Pregnancy Emergencies?

Team Acko Dec 17, 2025

All Articles

Want to post any comments?

ACKO Term Life insurance reimagined

ARN:L0072|*T&Cs Apply

Check life insurance