Home / Travel Insurance / Articles / Travel Tips / Trip Cancellation vs Trip Interruption: What’s the Difference?

Trip Cancellation vs Trip Interruption: What’s the Difference?

Team AckoSept 18, 2025

Share Post

There is no doubt that planning a holiday is an exciting experience. You book flights, find that perfect hotel, maybe even splurge on a cruise or adventure tour. But sometimes even the best-laid plans can fall apart. That is where travel insurance steps in. It has become a necessity.

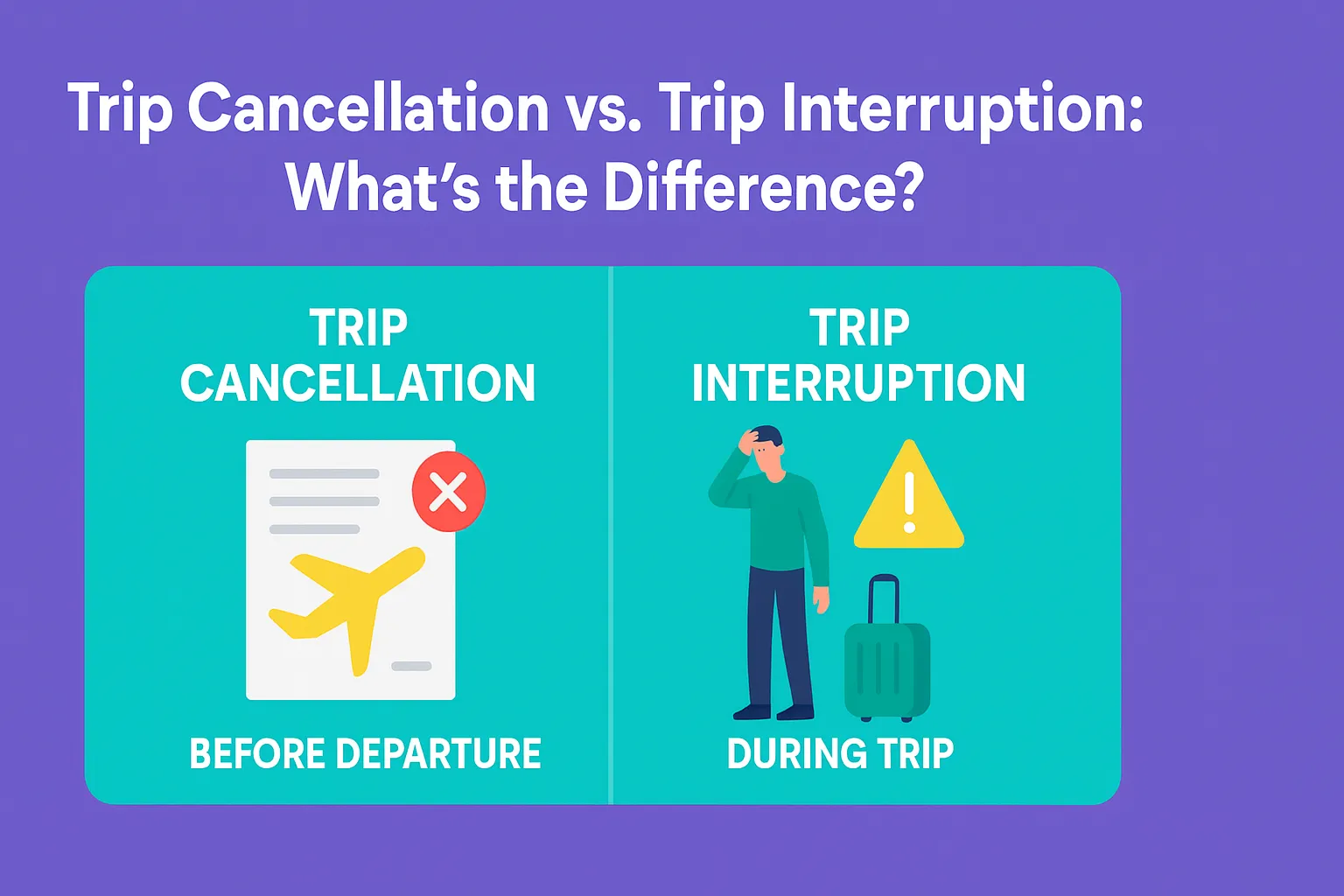

One of the most common areas of confusion is the difference between trip cancellation and trip interruption insurance. These two terms sound similar, but they cover very different situations. That is why it is vital to understand both so that you can choose the right travel insurance plan and protect your money if something goes wrong.

Contents

What is Trip Cancellation Insurance?

Trip cancellation insurance protects you before you even set off on your journey. Trip cancellation insurance reimburses you for your expenses in case you cancel your trip.

Imagine this:

You’ve booked a week in Spain, flights and hotels prepaid.

A week before departure, you catch the flu, and your doctor advises against travelling.

Without insurance, you’d lose all the money you’ve spent on non-refundable bookings.

With trip cancellation insurance, you can claim back those prepaid, non-refundable expenses, provided your reason for cancelling is listed as a covered reason in your travel insurance policy.

What are the reasons covered under Trip Cancellation?

These are just a few of the common situations that Trip Cancellation usually covers. Make sure to check the policy documents of the plan you’re looking at to see the full list of covered reasons.

Serious illness or injury (yours or a close family member)

Death of a family member

Natural disasters are making your home or destination uninhabitable

Being called for jury duty or certain work-related emergencies

What is not covered by Trip Cancellation Insurance?

Here are some common situations that usually aren’t covered under Trip Cancellation. Remember, your reason for cancelling has to be one of the covered reasons listed in your policy documents.

Cancelling because you changed your mind

Fear of travelling

Cancelling after a storm or disaster has already been announced

Trip cancellation helps you recover your money if you can’t go at all.

Read More: How Does Trip Cancellation Insurance Work?

What is Trip Interruption Insurance?

Trip interruption insurance applies once your holiday has already started.

Let’s say you’re in Italy on day three of a two-week trip when you receive bad news: a parent is suddenly hospitalised back home. You need to cut your holiday short and fly back immediately.

Trip interruption insurance can help by:

Reimbursing the unused portion of your prepaid bookings (like the remaining nights in your hotel or unused tours)

Covering additional costs to get you home quickly, such as a last-minute flight

What are the reasons covered under Trip Interruption?

A Trip Interruption benefit usually covers the following situations. The insurance documentation for the plan you are considering includes a comprehensive list of covered reasons for interruption.

A medical emergency during your trip

The death or serious illness of a family member back home

A natural disaster at your destination requires evacuation

Your travel provider is shutting down unexpectedly

What is not covered by Trip Interruption Insurance?

Here are some of the exclusions you could come across:

Leaving early because you don’t like your hotel

Homesickness

Deciding you’d just rather go home early

Giving birth to a child during your trip

Self-inflicted injuries

Trip interruption insurance helps when you’ve already left but need to cut things short for serious reasons.

What is the Difference between Trip Cancellation and Trip Interruption Insurance?

Here’s the simplest way to remember it:

Trip Cancellation Insurance = before you leave

Trip Interruption Insurance = after you’ve started

Both deal with unexpected events, but at different points in your journey.

Table for Trip Cancellation vs Trip Interruption

Feature | Trip Cancellation Insurance | Trip Interruption Insurance |

When it applies | Before departure | After the trip has begun |

What it covers | Prepaid, non-refundable expenses if you must cancel | Unused trip expenses + extra costs to return home |

Common reasons covered | Illness, injury, death, natural disaster, jury duty | Illness, injury, death, natural disaster, evacuation, travel provider failure |

Not usually covered | Changing your mind, cancelling after disaster is announced | Homesickness, bad accommodation, and voluntary changes |

Goal | Protects the money you lose if you can’t go at all | Protects the money you lose if you must cut the trip short |

Also Read: Important Documents Required for Travel Insurance Claims

Trip Cancellation + Trip Interruption: Why You Need Both?

Many travel insurance plans include both trip interruption and trip cancellation benefits, and for good reason.

Think about it:

If something happens while you’re away, you’re still covered.

If something happens before you go, you’re covered.

Without both, you risk losing hundreds or even thousands of rupees if life throws you a curveball.

Read More: How to buy the best Trip Cancellation Insurance Online?

Final Thoughts

When looking to buy international travel insurance, don’t just look at the price. Take your time to understand the difference between trip cancellation and trip interruption insurance. Both are beneficial and serve equally important purposes. Not to mention, life is unpredictable, as illnesses, family emergencies, or natural disasters can happen at any time. With the right protection, you can travel with peace of mind knowing that if plans change, your money doesn’t have to disappear with them.

Always read your plan documents carefully to understand your coverage, and call ACKO Assistance if you have any questions. Travellers covered by our insurance plans can access 24-hour assistance anytime via the ACKO app. Send us an email at [email protected] or call us at 18338138772 (for the US) and 022-69635374 (for other regions). We wish you safe—and uninterrupted—travels!

Frequently Asked Questions

Below are some of the frequently asked questions about travel Insurance

The following commonly asked questions are popular among customers interested in trip cancellation/interruption insurance:

What’s the difference between trip cancellation and trip interruption?

Trip cancellation applies before departure, covering prepaid non-refundable expenses if you can’t travel. Trip interruption applies after departure, covering unused bookings and extra costs if you must end your trip early.

What is trip cancellation insurance?

It’s insurance that refunds your prepaid expenses (like flights and hotels) if you have to cancel your holiday for a valid reason before you leave.

What is trip interruption insurance?

It’s insurance that helps if you’re already on holiday but must head home early due to illness, emergencies, or other covered events.

Do I need both trip cancellation and trip interruption insurance?

Yes. Cancellation protects you before your journey, and interruption protects you once you’re away. Many comprehensive travel insurance plans include both.

Are all reasons for cancelling covered?

No. Only the reasons listed in your policy count, such as illness, death in the family, or natural disaster. Cancelling just because you changed your mind won’t be covered.

What if I want flexibility to cancel for any reason?

Some insurers offer an optional upgrade called Cancel for Any Reason (CFAR) cover. It usually refunds part of your trip costs (often 50–75%) even if your reason isn’t listed.

Disclaimer: The content on this page is generic and shared only for informational and explanatory purposes. It is based on several secondary sources on the internet, and is subject to changes. Please check the policy document for cancellation reasons, and terms and conditions of the policy.

Recent

Articles

Is ₹1 crore term insurance enough?

Neviya Laishram Dec 17, 2025

Can I Buy Travel Insurance Today for My Trip Starting Tomorrow?

Team Acko Dec 16, 2025

What Does Individual Health Insurance Cover and Exclude

Roocha Kanade Dec 16, 2025

Family Health Insurance vs Individual Health Insurance: Key Differences

Roocha Kanade Dec 16, 2025

7 Reasons Why You Should Opt For Individual Health Insurance

Team Acko Dec 16, 2025

All Articles

Want to post any comments?

Ensure a safe trip with a comprehensive travel insurance plan.

Travel insurance plans starting @ ₹8*/per day

Get Quote