speak for ACKO

speak for ACKO

speak for ACKO

Home / Travel Insurance / Articles / Travel Tips / Which Medical Conditions Affect Travel Insurance?

Which Medical Conditions Affect Travel Insurance?

Team AckoOct 8, 2025

Share Post

The thought of travelling internationally fills most of us with excitement, new places to explore, new cultures to see, and plenty to look forward to. But before you get carried away with the fun part, it’s important to think about practical things like travel insurance. For people who have existing health issues, travel insurance can get a little tricky. Some medical conditions can impact whether you get full coverage, affect your premium, or even lead to claim rejections if not declared honestly.

This article covers everything you need to know about medical conditions that affect travel insurance.

Contents

What is a Medical Condition under Travel Insurance?

When we use the term 'medical condition' in the insurance context, it refers to any sickness or health issue you've previously been diagnosed with before purchasing your travel insurance policy. It may be something current, such as diabetes, or something that occurred in the past, such as a heart attack. Although you may feel healthy today, insurers will even take into account your past medical history when providing cover.

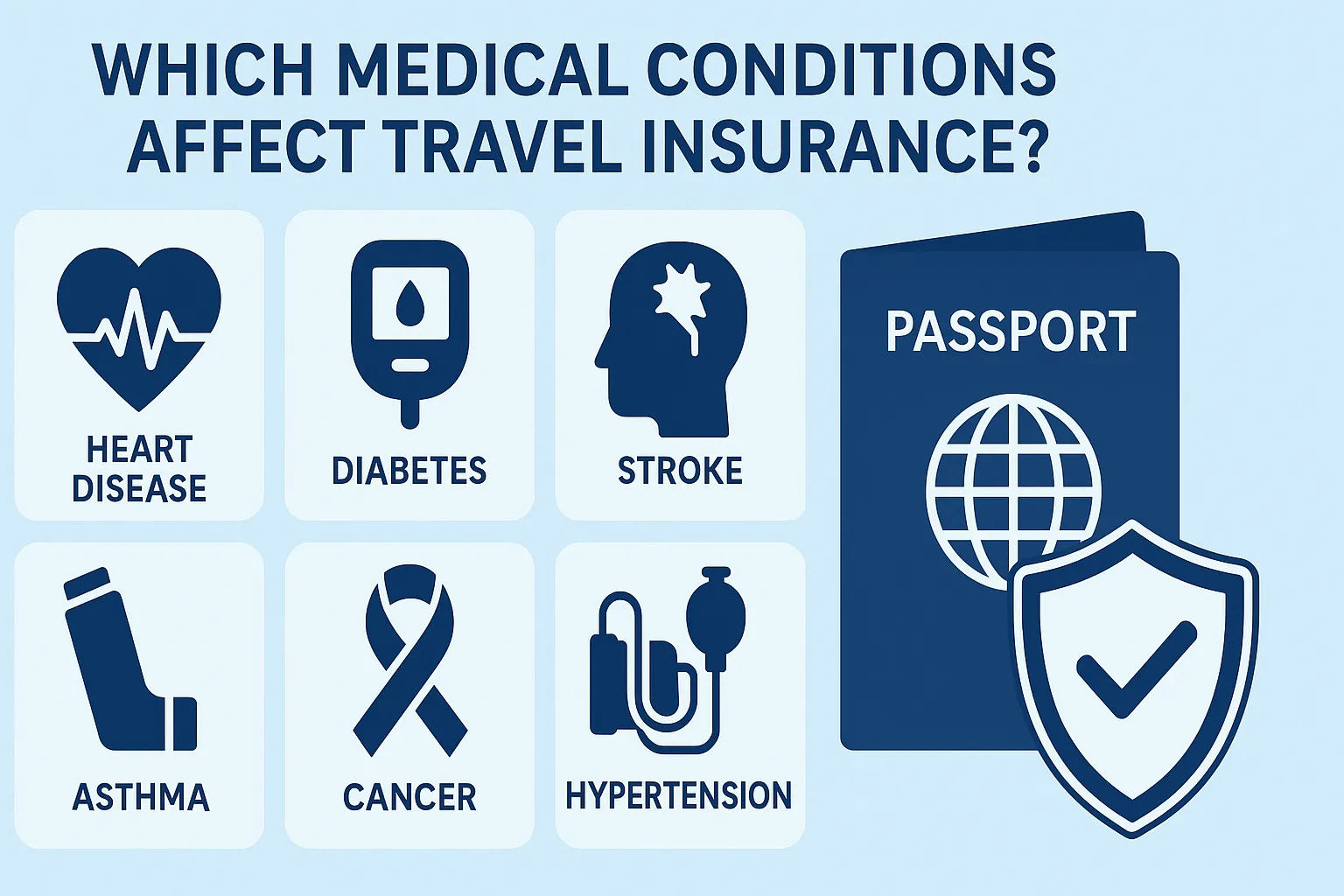

What Medical Conditions Affect Travel Insurance?

Certain medical conditions—like diabetes, heart problems, asthma, or high blood pressure—can affect your travel insurance coverage and premium. Being upfront about your health ensures you get the right protection and avoid claim issues during your trip. Here are the pre-existing medical conditions that might affect travel insurance:

1. Heart and Blood Pressure Issues

High blood pressure, arrhythmia (irregular heartbeat), or a history of heart attack are considered serious by insurers. Those with such conditions are considered at greater risk since emergencies such as chest pains or complications may require urgent attention overseas.

2. Diabetes

Both Type 1 and Type 2 diabetes are important when seeking travel insurance. Insurers typically inquire if you are on medication, insulin, or any attendant complications. If your condition is not well controlled, it could increase the premium cost of your policy.

3. Breathing Problems

Asthma, chronic bronchitis, or Chronic Obstructive Pulmonary Disease (COPD) can also impact your policy. If you treat your breathing illness with inhalers, though, insurers might require additional information since climatic variations or stress during travelling can trigger flare-ups.

4. Cancer or Ongoing Treatments

If you are undergoing cancer treatment or in remission, insurers may treat your case with extra caution. Some may cover it with added conditions, while others may charge higher premiums. You may also be asked for medical reports or a letter from your doctor.

5. Neurological Conditions

Issues such as epilepsy, multiple sclerosis, or a history of stroke are usually indicated by insurers. This is because these conditions may result in urgent medical requirements, which may be more difficult to handle in a foreign country.

6. Mental Health Issues

Depression, anxiety, or other mental illnesses also feature when it comes to travel insurance. Some policies do not include the cost of mentally debilitative emergencies abroad, and others may provide little help. Check thoroughly beforehand before buying.

| Planning an overseas getaway? Secure your journey with International Travel Insurance for complete peace of mind. |

Why Being Honest With Your Insurer Matters?

Most individuals avoid informing their ailments for fear of raising the premium. However, hiding it is not safe. When you claim any of your concerns related to the undeclared disease, the insurance firm may refuse your claim outright. So, you will have to pay out of your pocket for expensive treatments overseas.

Also Read: How to Decide if You Need Pre-Existing Coverage on Your Travel Insurance?

What is a Pre-Existing Condition in Insurance?

A pre-existing condition refers to any medical issue you have had before buying your travel insurance. In most cases, the insurer will count it as any illness for which you've ever been treated, advised, or placed on medication in the last few years or months. The time frame varies with insurers, so always check the terms of the policy.

Tips on Buying the Right Policy if You Have a Medical Condition

• Compare different policies: Not all insurers treat medical conditions the same way. Some might give you better terms than others.

• Look for add-on coverage: If your regular plan doesn’t cover a specific illness, see if you can buy extra pre-existing medical coverage.

• Read the exclusions carefully: Some policies exclude certain treatments linked to pre-existing conditions, so don’t skip the fine print.

• Get medical documents ready: You may be asked to submit reports, prescriptions, or a doctor’s note.

• Buy early: The earlier you buy your policy, the sooner you’re covered for cancellations or changes related to health issues.

Some insurers that started out online, such as ACKO, simplify the buying process by allowing you to disclose your medical history online in a few easy steps without requiring you to fill in endless forms.

Read More: Important Documents Required for Travel Insurance Claims

Final Words

A medical condition shouldn't deter you from travelling. Simply choose a policy appropriate for your health requirements, and you can enjoy your holiday without worrying about unexpected out-of-pocket costs.

Frequently Asked Questions

Do I need to disclose my high blood pressure if it is controlled by medication?

Yes. Even if you have it in hand, your insurers ought to know about it so they won't have claim issues down the road.

Will my premium increase if I have diabetes?

It could be. The premium tends to depend on how well you manage your condition and whether you have any complications related to it.

Can I get travel insurance if I have cancer?

Yes, although it costs more, and you may have to provide recent medical reports. Certain situations might only be covered by some insurers.

What if I don't declare my medical condition?

If your claim is related to that condition, the insurer can deny your claim, and you will have to pay all your costs overseas.

Do insurers insure mental health emergencies overseas?

Some do, but it might not be fully covered. Always read the terms specifically before purchasing.

Disclaimer: The content on this page is generic and shared only for informational and explanatory purposes. It is based on several secondary sources on the internet, and is subject to changes. Please check the policy document for cancellation reasons, and terms and conditions of the policy.

Recent

Articles

Who is an Appointee in Life Insurance?

Neviya Laishram Dec 22, 2025

What is Survival Benefit in Life Insurance?

Neviya Laishram Dec 22, 2025

How to Renew Your Individual Health Insurance Policy Easily Online

Roocha Kanade Dec 19, 2025

Is ₹1 crore term insurance enough?

Neviya Laishram Dec 17, 2025

Does Travel Insurance Cover Pregnancy Emergencies?

Team Acko Dec 17, 2025

All Articles

Want to post any comments?

Ensure a safe trip with a comprehensive travel insurance plan.

Travel insurance plans starting @ ₹45*/per day

Get Quote