Upto 85% off on Toyota Corolla Car Insurance

Buy or Renew Car Insurance Online in 2 Minutes ⚡️

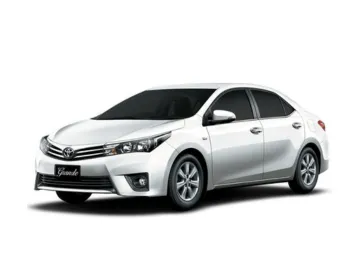

The Toyota Corolla is a stylish and reliable sedan that is known for its comfort, fuel efficiency, and durability. It is favourite among families and professionals because it offers a smooth drive, spacious interiors, and advanced safety features.

However, no matter how safe or dependable your Corolla is, it is still exposed to risks such as accidents, theft, or natural disasters. That is why having car insurance is essential. In fact, in India, it is a legal requirement to have at least basic car insurance before you can drive on public roads.

Owning an insurance policy for your Toyota Corolla provides a number of practical advantages:

If your Corolla suffers damage in a collision, the insurer pays for the repairs. This prevents you from having to arrange a large sum of money all at once.

Should your vehicle be stolen, your policy will compensate you based on the insured value, helping reduce the impact of the loss.

If you accidentally injure someone or damage their vehicle or property while driving, the insurance company will cover the cost of those third-party claims.

Severe weather events such as heavy rain, floods, or storms can cause serious damage to your vehicle. Insurance helps cover the cost of repairing these types of damage.

Knowing your finances are protected in case of unexpected incidents allows you to drive more comfortably and with peace of mind.

You can strengthen your coverage with optional add-ons such as roadside assistance, engine protection or zero-depreciation cover, depending on your needs.

In India, you can choose between two main types of car insurance:

This plan fulfils the basic legal requirement and covers you only if your car causes injury to others or damages someone else’s property or vehicle. Third-party car insurance does not include any protection for damage to your own car. It’s a low-cost option, designed purely to meet legal obligations.

This is a wider cover that protects both your own car and third parties. It includes protection against accidental damage, theft, fire, weather-related incidents and more. On top of that, you can add extra covers (like roadside help or zero depreciation) to suit your needs. It is more expensive than third-party insurance, but it provides far greater protection.

| Feature | Comprehensive Plan | Third-party Plan |

| Covers damage to other people’s property/vehicle | Yes | Yes |

| Covers injury/death of another person | Yes | Yes |

| Covers damage to your own car | Yes | No |

| Covers theft of your car | Yes | No |

| Covers natural disasters | Yes | No |

| Covers fire damage | Yes | No |

| Option to add extra covers | Yes | No |

| Premium cost | Higher | Lower |

| Best for | People who want full protection | People looking for basic legal cover |

Your Toyota Corolla insurance provides protection in the situations listed below:

Your Toyota Corolla insurance will not provide any cover in the following situations:

Add-ons are optional extras you can buy with a comprehensive plan for better coverage. Here are some add-ons you must know.

Get the full cost of replaced parts without depreciation cuts during claims.

Covers small items like nuts, bolts, and engine oil used in repairs.

Get towing, battery jump-starts, flat tyre help, and more if your car breaks down.

If your Corolla is stolen or totalled, you get the original invoice value, not the depreciated amount.

Covers damage to your car’s engine and gearbox, including hybrid components if applicable.

Covers the cost of replacing lost or stolen car keys.

Keeps your No Claim Bonus intact even after you make a claim.

The cost of insuring your Toyota Corolla depends on a few factors, which are as follows:

Type of policy: Comprehensive plans cost more than third-party ones.

Add-ons: Adding extras will increase your premium.

Car’s age: Older cars usually have lower premiums but also a lower IDV (Insured Declared Value).

Location: Premiums can be higher in accident- or theft-prone areas.

No Claim Bonus: Discounts are given if you haven’t made claims in previous years.

Voluntary deductible: Agreeing to pay part of the claim amount can lower your premium.

Here is a rundown of some advantages you get by buying ACKO car insurance for your Toyota Corolla.

Buying, renewing, and making a claim are all 100% digital and can be done from the comfort of your home without any physical paperwork.

Get your policy within minutes of payment, straight to your email.

Many minor claims are settled within 24 hours when you have a car insurance policy with ACKO.

Buy directly from ACKO and save on agent commissions.

In select cities, ACKO can pick up, repair, and return your car.

If you have a hybrid Corolla, plans can cover battery and electric components too.

Follow these steps to buy ACKO car insurance.

With ACKO, paperwork is minimal. You may need the following documents:

Here’s how you can make a claim.

Step 1: Log in to your ACKO account (website or app).

Step 2: Select your Toyota Corolla policy.

Step 3: Click ‘Claim Now’.

Step 4: Upload photos/videos of the damage.

Step 5: For minor claims, ACKO may directly transfer the amount to your bank within hours.

Step 6: For major repairs, ACKO will arrange towing, repairs, and drop-off.

The Toyota Corolla is one of the world’s best-selling sedans, known for its dependability and comfort. It offers:

It is a great choice for both families and professionals who want a practical, reliable, and premium-feeling car for daily use.

The Corolla competes with other sedans in India, such as: