Upto 85% off on Audi A7 Car Insurance

Buy or Renew Car Insurance Online in 2 Minutes ⚡️

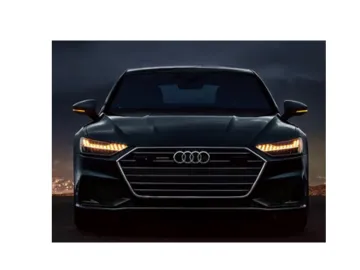

For those who see driving as more than a routine, the Audi A7 is the perfect companion. Its artistry, power, and luxury redefine what a sedan can be. To protect a car as iconic as this, you need insurance that’s equally forward-thinking. With ACKO, Audi A7 owners enjoy a blend of protection and simplicity that complements their lifestyle.

Insuring an Audi A7 with the right coverage offers benefits that align with the lifestyle of a luxury car owner:

Listed below are the major types of car insurance:

| Feature | Comprehensive Plan | Third-party Plan |

| Covers damages to third-party vehicle/property | ✔ | ✔ |

| Covers injury or death of third-party | ✔ | ✔ |

| Covers damage to your own car | ✔ | ✘ |

| Protection against theft | ✔ | ✘ |

| Coverage for natural disasters | ✔ | ✘ |

| Coverage for fire or explosion | ✔ | ✘ |

| Option to include add-ons like Zero Depreciation, etc. | ✔ | ✘ |

| Legal requirement under the Motor Vehicles Act | ✘ | ✔ |

| Complete protection | ✔ | ✘ |

Add-ons make your policy better to suit the specific needs of a luxury car. Some popular options include:

The insurance premium for the Audi A7 is influenced by several key factors, each tailored to reflect the value and sophistication of this luxury sedan.

Owning an Audi A7 is a celebration of elegance and engineering excellence. When it comes to protecting such an investment, the experience should be equally premium. Choosing ACKO for your Audi A7 ensures that insurance isn’t just a formality, but an effortless extension of your luxury lifestyle.

ACKO’s direct-to-customer model removes the need for agents and commissions, making premiums more competitive without compromising the quality of coverage. For Audi A7 owners, this means getting top-tier protection at a price that feels surprisingly efficient.

From purchasing to renewing policies, every step is online. No paperwork, no signatures, no delays. Whether you’re at home, at work, or travelling abroad, you can manage your A7’s insurance in just a few clicks.

Luxury car owners value time as much as quality. ACKO understands this, offering quick settlements for minor claims, sometimes within hours, so you spend less time worrying and more time enjoying the drive.

The Audi A7 deserves more than just basic coverage. With add-ons like Zero Depreciation, Engine Protection, or Key Replacement, you can personalise your plan to safeguard the finer details of your car’s design and technology.

Emergencies don’t follow business hours. With 24/7 customer support, ACKO ensures help is always available, no matter where or when you need it.

Renewing your policy is as seamless as buying it. With digital reminders and instant renewal options, your Audi A7 is always covered without disruptions.

ACKO’s paperless, digital-first process makes insuring your Audi A7 effortless, just sharing a few basic details, and your car is covered within minutes.

ACKO’s claim procedure is quite simple, all you have to do is follow these steps:

Step 1: Log in to your ACKO account through the website or app.

Step 2: Select your Audi A7 policy.

Step 3: Click on “Register a Claim.”

Step 4: Upload necessary details and documents digitally.

Step 5: Track your claim in real time.

A sleek Sportback design that combines the elegance of a coupe with the practicality of a sedan. The interiors are designed with premium materials, a minimalist dashboard, and advanced infotainment systems, creating a refined cabin. It has a digital cockpit, touch interfaces, and driver-assistance features for a futuristic driving experience. Moreover, the spacious interior and practical boot space, despite its sleek design, make it a go-to choice for luxury everyday rides.

The Audi A7 competes with other premium sedans and luxury sportbacks, such as: